PRINT Pending Homes Sales Report June 2010

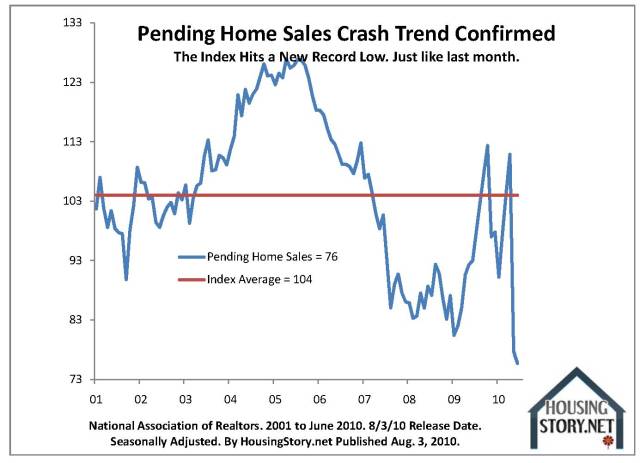

The index of pending home sales fell to a new record low and replaced last month’s reading of a new record low. If that sounds like a broken record you have listened carefully.

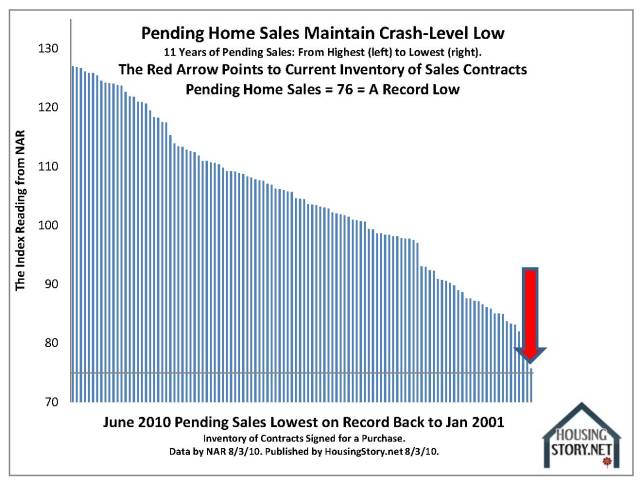

Pending-home sales have fallen below the worst numbers seen in the housing crash and going back to the inception of this measurement.

The chart above shows a veritable death march in the state of American residential property. It clearly proves shallow demand. The inventory of signed contracts cannot sustain current price levels. That means prices are falling unless we experience divine intervention.

The National Association of Realtors (NAR) announced the figures today, but made no mention of the record low in its press release. This is exactly the same method the NAR followed in last month’s release when they made no mention of a record fall or a new record low. They did report the raw data which is a great courtesy.

We also find again this month that major news outlets are dumb and incapable of understanding this most obvious of indicators (Headlines from the big sites follow at the end of this post. They did figure out there was a fall in the index. And that it fell 2.6%. So they read two paragraphs of the press release.). Last month was also a record low and the first report on pending sales following the April 30th expiration of the free-down-payment program.

The pending-home-sales stat gives us our best view of buyer demand without the hugely popular down-payment prop from the federal government. The news is not good and it flew right over the head of our correspondents at 15 major mainstream publications including Bloomberg, Associated Press, Reuters, and Marketwatch.

The chart of pending contracts above is literally a fall into the abyss. The May and June pending-sale figures are as bad as it gets; at least so far. HousingStory.net estimates current inventory for sale of 4 million units is 1.3 million units higher than it should be, and not too far away from the record high 4.5 million for sale.

Two months in a row of pathetic pending-home sales inventory figures will surely change months of units for sale. They are currently at 8.9 months and far above the average 5.8 months. The record high inventory is 11.3 months in April 2008.

Prices for residential real estate have been flat since August 2009, but are down 30% from their peak. Pending home sales suggest a new fall – for those with eyes to see and ears to hear.

Lawrence Yun, NAR chief economist, has a different take on it. “Since home prices have come down to fundamentally justifiable levels” Dr. Yun said today, “there isn’t likely to be any meaningful change to national home values.” That’s a brave forecast. I wonder if Dr. Yun is a renter or an owner? Is his home on the market? If his child was buying a home today, would he mention the record-low buyer demand?

***

PRINT Pending Homes Sales Report June 2010

See also Calculated Risk on pending sales.

***

***

***

***

***

Hi Mike,

Clearly at this point the MSM, Politicians, and controlling powers can’t have you running around writing truthfully about what’s happening. You’re going to scare the very sheeple they need to believe in the system, and to consume lots of stuff including real estate.

The major financial players own Washington, and that was clear the day they changed all the accounting rules to pretend that mortgages are still worth Par, and our financial system isn’t hopelessly corrupt and busted.

It’s maddening, but I suggest you get with the program and stop complaining. It’s better to understand what their master plan is so you can get ahead of the wave and protect your investments.

I suggest buying high quality stocks on every pull back. I simply don’t see the Feds giving up anytime soon. They’ll keep printing funny money and handing it out like candy until real signs of inflation show up. And I don’t see any in my neck of the woods.

The pending home sales numbers and purchase mortgage #’s look horrendous, so what will happen? The Feds will drive mortgage rates to previously inconceivable levels. Expect 30 Yr conventionals at 3% within 12 months unless price stability and job growth begin. Why? Because all the money is loaned out mostly for real estate backed deals. If residential and commercial head back down, the financial system is insolvent, the natives will become very restless, and bad things will happen. As sick as it makes me feel, hold your nose and hope the current plan works out. The alternatives look pretty bad, and I have little faith that our lazy, chubby citizenry are smart enough to embrace tougher solutions that might actually help.

Depressed in Southern NH.

Any opinion on the Miami real estate market? Seems like it’s time to buy here in the “working class neighborhoods” near downtown miami and brickell.

Hi Roly i don’t have insight on FL. thanks for your comment. mdw

If you think this is the best time to buy a house, go ahead. You’ll be underwater yourself in 1-2 years. There will be a minimal drop of 20% yet to come….way to early to get in….

http://bayarearealestatetrends.com/2010/08/it-is-too-soon-to-buy-and-hold/?source=patrick.net

Hi AWV, i would go with the line saying “the world cannot be predicted”. thanks for your comment. mdw

Hi Michael – a real-estate radio show in my area said Saturday that The Big Banks plan to start unloading their inventory of REO homes in 60-90 days, and he told listeners to sell now if they want to sell, as this new inventory will drive prices down further. (prices in my area are still not consistent with incomes – at least 25% too high for anything over $200,000)

What makes me laugh is the Major New Media doesn’t have an issue with people shopping at WalMart to save $$, but waiting for real-estate prices to drop to save $$ is bad somehow. Ha ha ha ha.

Hi Hank, it sure makes sense to me that all else being equal you wait to buy. too much risk in the market now. thanks for your comment. mdw

There’s never been a better time to buy a house.

Hi Don, where are you calling from? Las Vegas? mdw

Is there anyone with a brain who listens to Dr. Yun without immediately and unconditionally reversing everything that he says?

Hi Modgen, I think you will do well with that policy. mdw